بطاقة الإنماء الفرسان الائتمانية تقدم عروض حصرية مع برنامج الفرسان من الخطوط الجوية العربية السعودية

بطاقة الإنماء الائتمانية تتيح لكم حرية استخدامها داخل أو خارج المملكة مع امكانية تسديد مستحقات البطاقة بأقساط شهرية ميسرة

يوفر للعملاء فرصة الحصول على سيارة من اختياره مع إمكانية تملك المركبة

نساهم في تحقيق حلمك من خلال التمويل على شكل مرابحة والذي يعكس قيمنا القائمة على الابتكار والاحترام والشفافية

نحن في مصرف الإنماء نساند تطلعاتك من خلال تمويل الأسهم

في مصرف الإنماء نحرص على تنمية مواردك المالية من خلال منتج نماء لمنحك عوائد استثمارية

نقدم تجربة مصرفية متميزة لعملائنا، ويسعدنا انضمامك للحصول على أفضل مستويات الخدمة من خلال منتجات مصرفية متكاملة

في مصرف الإنماء ندرك مدى حرصك واهتمامك بعائلتك، لذا حرصنا على تقديم خدمة حساب الأسرة

استشعاراً للدور الكبير الذي يقوم به منسوبي التعليم في نهضة الوطن ودورهم في تخريج أجيال المستقبل فقد قمنا بتصميم

إذا لم يكن لديك حساب في مصرف الإنماء يمكنك الآن وبكل يسر وسهولة فتح حساب جاري رقمي

في مصرف الإنماء نحرص على تنمية مواردك المالية من خلال منتج نماء لمنحك عوائد استثمارية

بهدف مساعدتك على الادخار والتخطيط لمستقبلك، نتيح لك حساب الادخار بأكثر من باقة، والمصمم بمرونة عالية تلائم احتياجك

تمنحك هذه الخدمة فرصة الادخار أو التبرع لأحد الجمعيات الخيرية بعدة خيارات

نحن في مصرف الإنماء نساند تطلعاتك ونحقق رغباتك بتوفير حلول مالية

يوفر للعملاء فرصة الحصول على سيارة من اختياره مع إمكانية تملك المركبة

نساهم في تحقيق حلمك من خلال التمويل على شكل مرابحة والذي يعكس قيمنا القائمة على الابتكار والاحترام والشفافية

نحن في مصرف الإنماء نساند تطلعاتك من خلال تمويل الأسهم

نحن في مصرف الإنماء نسهم في تأمين مستقبل واعد لك ولأبنائك من خلال خدمة تقسيط التعليم

قم بطلب تمويلك الآن بتعبئة معلوماتك الشخصية و بيانات الاتصال وسوف نقوم بالاتصال بك خلال 24 ساعة (خلال أيام العمل)

بطاقة الإنماء الفرسان الائتمانية تقدم عروض حصرية مع برنامج الفرسان من الخطوط الجوية العربية السعودية

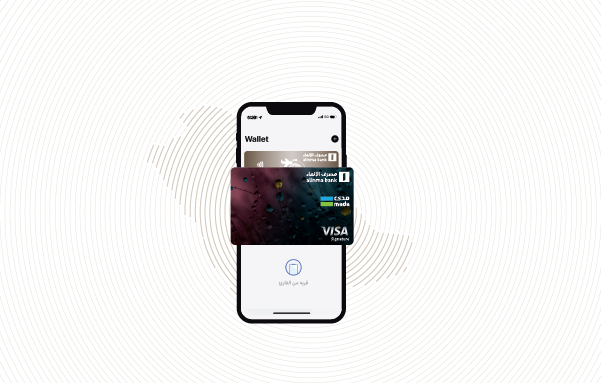

بطاقات الإنماء مدى التي تتيح لكم سهولة الاستخدام مع مميزات أمنية عالية عند استخدام البطاقة داخل أو خارج المملكة للسحب النقدي

بطاقة المسافر هي بطاقة عملات متعددة ذات حد ائتماني منخفض

خدمة "بطاقات الإنماء الرقمية" والتي تتيح للعميل إصدار فوري لبطاقات الإنماء مدى والمسافر دون الحاجة لطباعة البطاقة البلاستكية

ميزة أمان البطاقة الجديدة التي تمنحك المرونة لتمكين أو تعطيل الشراء عبر الإنترنت على بطاقاتك

تقديراً للعلاقة المتميزة التي تربطنا بك، و إدراكاً منا لشغفك بالجودة والتميز.. نقدم لكم خدمة الدخول لصالات كبار الشخصيات

تعرف أكثر على رسوم وتكاليف البطاقات

نتيح لك في مصرف الإنماء تطبيق الإنماء للأجهزة الذكية الذي يمكنك من التعامل على حساباتك بسرعة وسهولة لإنجاز تعاملاتك المصرفية

تعرف أكثر عن خدمة تحويل الإنماء

يسرنا أن نقدم لكم خدمة إصدار الشهادات المصرفية الرقمية عبر إنترنت أو تطبيق الإنماء دون الحاجة إلى زيارة الفرع

تعرف أكثر عن خدمة النقد الطارئ

يمكنك وبكل يسر وسهولة تحديث بياناتك الشخصية والعنوان رقميًا من خلال القنوات الإلكترونية لمصرف الإنماء دون الحاجة لزيارة الفرع

أصبح بإمكان عملاء مصرف الإنماء طباعة بطاقاتهم المصرفية من خلال أجهزة الإنماء للصرف الآلي ودون الحاجة لزيارة الفرع

يمكنك الآن بكل سرعة وسهولة تسجيل الدخول السريع في تطبيق الإنماء دون الحاجة لإدخال اسم المستخدم أو كلمة المرور أو رمز التفعيل

تعرف أكثر عن عروض المنتجات والخدمات

بدون رسوم تجديد مدى الحياة حتى 31 أغسطس 2023

يسرنا تقديم عروض وتخفيضات بالشراكة مع نخبة من الأسماء التجارية بمجرد استخدام بطاقة الإنماء

لأنك تستحق أكثر .. احصل على أفضل المكافآت كل يوم!